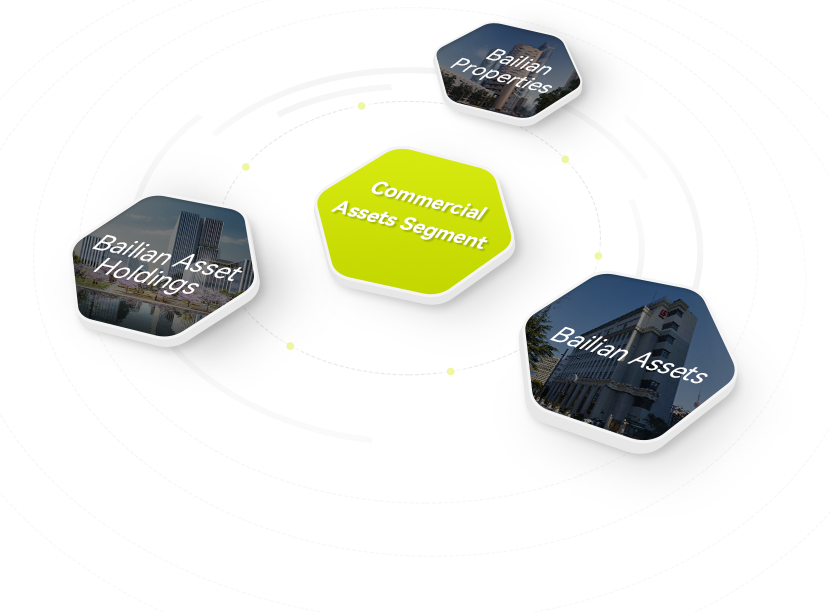

Commercial Assets

As a key pillar of Bailian Group's "One Core, Three Pillars" industrial system, the Commercial Assets segment adheres to the principles of innovation-driven growth, synergistic development, and sustainability. Focusing on the development, operation, and revitalization of the Group's existing assets, it deeply explores asset potential and strives to enhance the value of commercial assets. Currently, the segment comprises three subsidiaries: Bailian Group Property Co., Ltd., Shanghai Bailian Capital Holdings Co., Ltd., and Shanghai Bailian Group Asset Management Co., Ltd. These entities manage the Group's diversified commercial assets—including office buildings, industrial parks, hotels, and long-term rental apartments—throughout their entire lifecycle, actively contributing to urban space upgrading and regional economic vitality.

During the "14th Five-Year Plan" period, the Commercial Assets segment has comprehensively accelerated urban renewal efforts, promoting the rational allocation and efficient utilization of spatial resources. In recent years, through functional reconstruction, business repositioning, and scene redesign of historical buildings, the segment has integrated art, culture, fashion, and leisure to gradually create diverse spaces that combine "fashion, culture, art, and technology." It has successfully established brands such as "B-Space" and attracted renowned domestic and international enterprises like Fotografiska and IGG. Simultaneously, actively fulfilling its social responsibilities as a state-owned enterprise, the segment has participated in the city's talent-oriented rental housing initiatives, launching the "Heguangyu" long-term apartment product line brand. By continuously optimizing operational models, enhancing service quality, and strengthening brand influence, the Bailian Commercial Assets segment continues to advance high-quality development in the revitalization of existing assets.

Bailian Group Property Co., Ltd. (abbreviated as Bailian Property) is a wholly-owned subsidiary of Bailian Group, serving as the Group’s intensive operation service platform for key assets. Its business spans property leasing, park operation, warehousing and logistics, creative renovation, property management, community services, home maintenance and housekeeping, residential and commercial decoration, foreign vessel supply, pawnbroking, and auction services. Adopting a competitive strategy centered on intensification, specialization, differentiation, and branding, Bailian Property fully leverages synergies and interconnected advantages across its business segments. It continuously enhances core capabilities in product planning, construction management, marketing services, and digitalization, striving to fully implement the Group’s strategic directive of "improving quality and efficiency, strengthening capabilities and effectiveness, and supporting the transformation and development of core business segments."

-

Intensification

Intensification -

Specialization

Specialization -

Differentiation

Differentiation -

Branding

Branding

Group Core Asset Development and Intensive Operation Management Platform

Shanghai Bailian Capital Holdings Co., Ltd. (referred to as "Bailian Capital") is a wholly-owned subsidiary of Bailian Group, serving as the Group's core asset development and intensive operation management platform. Leveraging the Group's robust industrial capital, Bailian Capital actively seizes policy opportunities in urban renewal and the opening of consumer REITs. It focuses on three major business segments: commercial property renovation and upgrading, industrial transformation development, and Pre-REITs and asset securitization. Centered on "Asset Development + Asset Management + Capital Operations," Bailian Capital continuously enhances the core capabilities of its professional asset management platform, striving to become a pivotal pillar of Bailian's commercial asset strategy and a benchmark enterprise in Shanghai's urban renewal sector.

Shanghai Bailian Group Asset Management Co., Ltd. (referred to as "Bailian Assets") is a wholly-owned subsidiary of Bailian Group, specializing in building a professional platform for group asset disposal and asset custody. Its core business includes equity management, debt recovery, bankruptcy liquidation, asset operation, asset disposal, and enterprise liquidation. It manages or provides custodial services for nearly 90 enterprises, such as Shanghai Senlian Wood Industry Development Co., Ltd., Shanghai Fuel Co., Ltd., Shanghai Commercial Investment Industrial Investment Holding Co., Ltd., and Shanghai Mechanical & Electrical Equipment Corporation. Adhering to the overarching principle of "seeking progress while maintaining stability and ensuring quality in progress," Bailian Assets actively establishes market-oriented operational mechanisms, improves the group's capital management platform, enhances the quality and efficiency of existing assets, and supports the group's development strategy.

Brunner Mond & Co. (Former British Trading Firm)

133 Middle Sichuan Road

Kane Building

117 Xianggang Road

Bailian Fashion Center - Yanqing Lane (A Historic Building)

Nos. 955 & 991, South Suzhou Road

Sihang Tiandi (at Sihang Warehouse)

18 North Xizang Road

Sihang Warehouse (The Defenders’ Memorial)

No. 1, Guangfu Road

Guang’er Warehouse (A Protected Historical Building)

195 Guangfu Road

Guangsan Warehouse (A Protected Historical Building)

127 Guangfu Road

Maden Warehouse (A Protected Historical Building)

147 Yangshupu Road

Yongxing Warehouse (A Protected Historical Building)

61 Yangshupu Road

Bai Space - Huai'an Road

668 Huai'an Road

Huzhou Silk Guild Hall

No. 12, Alley 1384, Wanhangdu Road